Grow & Protect Wealth. Through Scientific Investment Strategies.

Join 10,000+ families who trust our independent research-backed approach to achieve their financial goals.

Trust is the Only Currency We Pursue

4,985+

Trusting Families

985+

Client Locations

985 Cr

Portfolios Tracked

25+

Years of Market Insight

Our Core Values

Client first

Client first 100% transparent

100% transparent 0 conflict of interest

0 conflict of interest No hidden fee

No hidden fee

Clients Who Trust Us

10,000+ families

10,000+ families Empanelled at Large Corporates

Empanelled at Large Corporates Clients from 1000+ locations

Clients from 1000+ locations

Expertise That Inspires Confidence

IIM, IIT, CA Rank-holders at the helm

IIM, IIT, CA Rank-holders at the helm 25+ Years Financial Expertise

25+ Years Financial Expertise Global CXO-Level Expertise

Global CXO-Level Expertise

Research Span & Technology

5000+ stocks scanned

5000+ stocks scanned 1500+ mutual funds researched

1500+ mutual funds researched 25+ years of data

25+ years of data AI-Driven Portfolio Construction

AI-Driven Portfolio Construction

AI-Powered Investing

Proprietary Risk Models using AI/ML

Proprietary Risk Models using AI/ML Dynamic Portfolio Rebalancing

Dynamic Portfolio Rebalancing Market Sentiment & Volatility Tracking

Market Sentiment & Volatility Tracking Automated Alerts & Decision Support

Automated Alerts & Decision Support

Our Core Values

Client first

Client first 100% transparent

100% transparent 0 conflict of interest

0 conflict of interest No hidden fee

No hidden fee

Clients Who Trust Us

10,000+ families

10,000+ families Empanelled at Large Corporates

Empanelled at Large Corporates Clients from 1000+ locations

Clients from 1000+ locations

Expertise That Inspires Confidence

IIM, IIT, CA Rank-holders at the helm

IIM, IIT, CA Rank-holders at the helm 25+ Years Financial Expertise

25+ Years Financial Expertise Global CXO-Level Expertise

Global CXO-Level Expertise

Research Span & Technology

5000+ stocks scanned

5000+ stocks scanned 1500+ mutual funds researched

1500+ mutual funds researched 25+ years of data

25+ years of data AI-Driven Portfolio Construction

AI-Driven Portfolio Construction

AI-Powered Investing

Proprietary Risk Models using AI/ML

Proprietary Risk Models using AI/ML Dynamic Portfolio Rebalancing

Dynamic Portfolio Rebalancing Market Sentiment & Volatility Tracking

Market Sentiment & Volatility Tracking Automated Alerts & Decision Support

Automated Alerts & Decision Support

Gain Peace of Mind With Our Proven Strategies

FOCUSED EQUITY

Better alpha with quality

Roots & Wings Investment Philosophy

Three Lens Framework

DYNAMIC SAFETY

Harvest gains for cashflows

LSG framework for asset allocation

Rebalancing periodically for safety

ALTERNATES

Boost risk adjusted return

Active Momentum

Hedging for crash protection

AIFs, REITs, InvIT

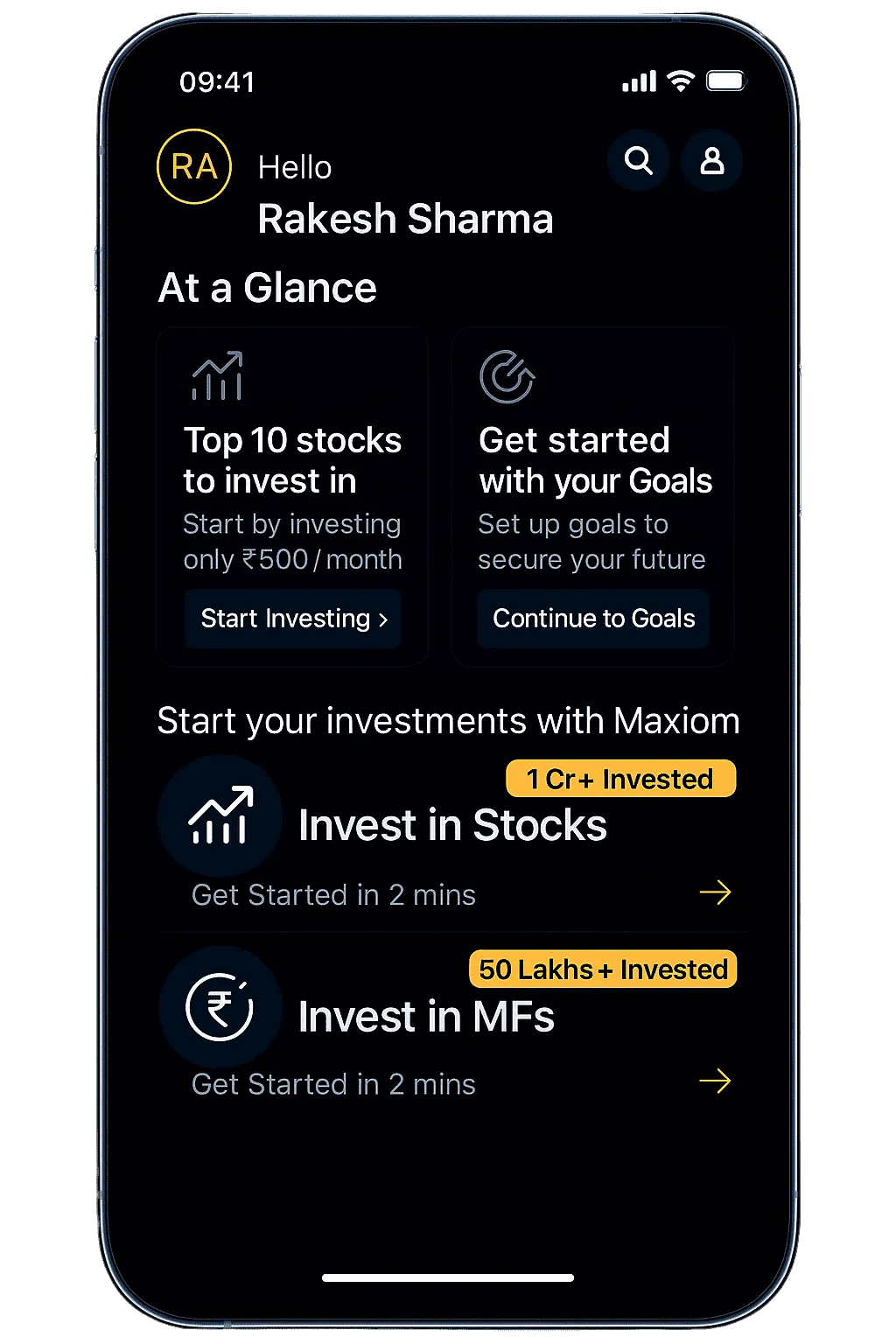

Get more out of your portfolio. With our free analysis.

Evaluate your portfolio against market benchmarks

Compare your investments with established market indices like Nifty 50 TRI

Your Portfolio

Current year-to-date performance

Know your portfolio risks within minutes

Get detailed analysis of your portfolio's risk metrics and diversification status across market caps

Portfolio Risk Analysis

Risk factors identified in your current portfolio

5 out of 7 funds may need attention for optimal performance

Get expert guidance through a personal consultation

Schedule a 1-on-1 call with our investment experts to discuss your portfolio strategy

Expert Consultation

Schedule a call with our investment experts

Start a Goal Based Investment

Set financial goals that truly matter

Prioritize investments based on your life goals like buying a house, child education, or retirement.

Home Purchase

5-7 Years

Child Education

10-15 Years

Retirement

20-25 Years

Get personalized investment strategy

Our algorithms craft a goal-based strategy tailored to your timeline and risk tolerance.

Timeline Analysis

Short & Long Term

Risk Assessment

Tolerance Matching

Goal Alignment

Priority Based

AI Algorithm

Smart optimization

Goals Progress Dashboard

Track your financial goals and monitor progress toward achievement.