Investment Advisory For Mid Cap Mutual Funds

Mid-Cap Fund Advisory. Embark on a Mid-Cap Adventure.

Discover the dynamic world of mid-cap mutual funds. With our meticulous guidance, you can tap into the potential of these growth-centric funds, optimising returns while strategically managing associated risks. Let’s navigate the mid-cap landscape together.

Why Choose Mid-Cap Fund Advisory?

Potential High Growth

Mid-cap funds often provide higher growth prospects.

Diversification

They allow exposure to a broad array of promising sectors.

Robust Returns

Historically, mid-cap funds have showcased notable returns.

Balance of Risk & Return

Strategic Investment

Ideal for investors seeking long-term growth.

Focused Expertise

Our team specialises in decoding the mid-cap fund universe.

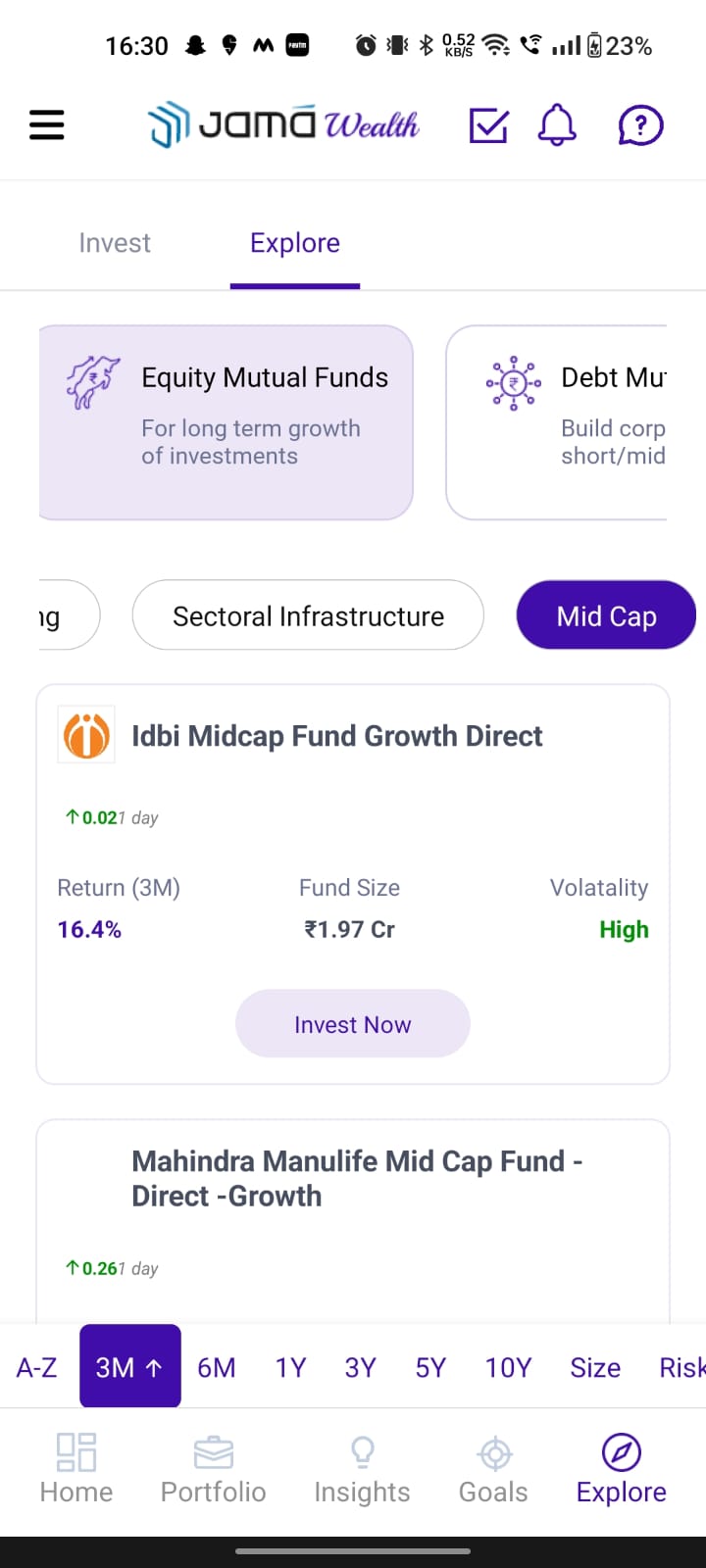

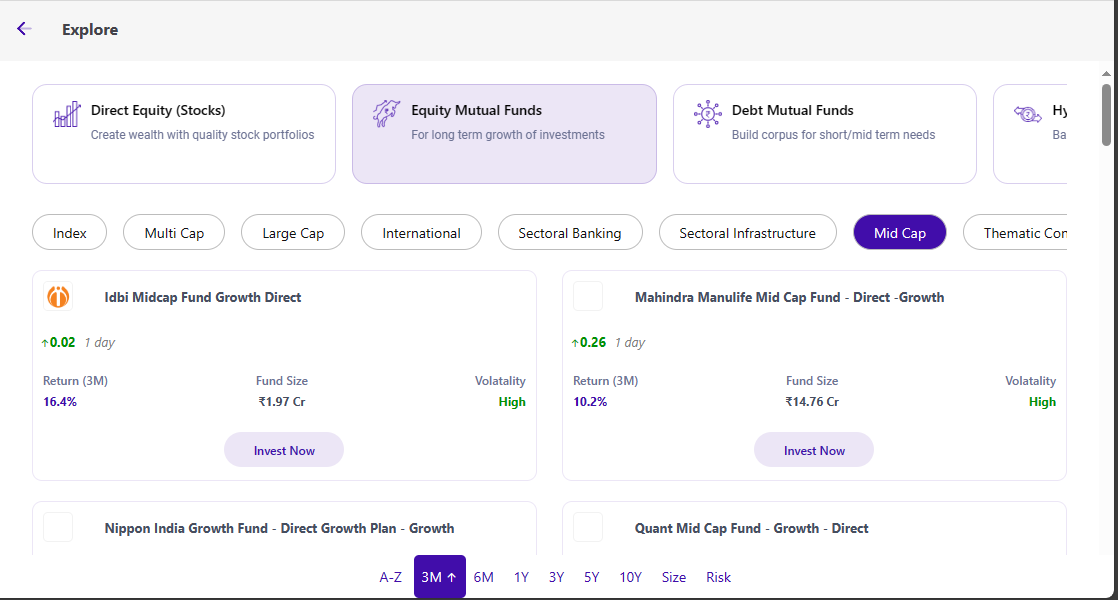

Our Offerings in Mid-Cap Fund Advisory

Expert Guidance

Navigating the intricacies of mid-cap fund investments with unparalleled expertise.

Optimized Returns Strategy

Harness the full growth potential of mid-cap funds with strategic planning.

Risk Management

Informed strategies to manage risks associated with dynamic mid-cap funds.

Personalized Financial Advising

Collaborate with dedicated financial advisors for bespoke mid-cap fund portfolios.

Unique Features of Our Mid-Cap Fund Advisory

Research-Driven

Recommendations backed by rigorous data analysis.

Tailored Portfolios

Designed aligning with individual investment goals.

Timely Rebalancing

Ensuring portfolios remain optimised amidst market fluctuations.

Regulatory Adherence

Our processes strictly abide by SEBI guidelines.

Transparent Reporting

Stay informed with clear and regular portfolio updates.

Client-Centric Approach

Your financial objectives remain our primary focus.

Prime Benefits of Investing in Mid-Cap Funds

Growth Opportunity

Tap into the vast growth potential offered by emerging market leaders.

Strategic Insights

Benefit from expert perspectives on maximizing mid-cap fund returns.

Balanced Portfolio

Achieve a blend of risk and reward with diverse mid-cap fund selections.

Dedicated Advisory

Partner with seasoned financial advisors specialized in mid-cap fund portfolios.

Frequently Asked Questions

What are mid-cap mutual funds?

These funds invest in medium-sized companies that have significant growth potential.

How do mid-cap funds differ from large-cap?

Mid-cap funds typically have higher growth potential, albeit with increased volatility.

Is mid-cap fund investing suitable for me?

If you seek growth and are willing to tolerate moderate risk, it could be an ideal choice.

How does risk management work in mid-cap investing?

Through diversification and strategic asset allocation, we mitigate potential risks.

Can I combine mid-cap with other fund categories?

How frequently should I review my mid-cap investments?

Periodic reviews are recommended. We offer continuous monitoring and advice.