Financial Planning For Those Emigrating From India

Emigration Financial Planning. Secure Your Global Financial Future.

Emigrating from India brings fresh financial landscapes. Our expert guidance ensures smooth transitions, maximizing financial stability abroad while leveraging tax-efficient strategies specially designed for Indian emigrants.

Why Prioritise Emigration Financial Planning?

Changing Economies

Understand diverse financial landscapes and adjust your investment strategies accordingly.

Protecting Assets

While emigrating, secure your investments and assets in India and your new home country.

Tax Complications

Moving countries can lead to complex tax situations; proactive planning is vital.

Currency Fluctuations

Estate Planning

Ensure your assets are well-managed and passed on efficiently across borders.

New Financial Products

Explore and understand financial products in your new country, ensuring best choices.

Emigration Financial Planning Services

Cross-border Investments

Craft a diversified portfolio balancing assets in India and abroad.

Estate Planning Advisory

Ensure your legacy is efficiently managed and passed on, irrespective of geographies.

Taxation Advisory

Navigating dual taxation and other emigration tax challenges become simpler with our guidance.

Insurance Guidance

Secure yourself with the right insurance plans suitable for your new location.

How Our Unique Approach Supports Emigrants

Global Financial View

Our expertise in mutual funds and stocks aids in building a comprehensive global portfolio.

Integrated Digital Solutions

Our platform smoothly connects every aspect of financial planning, tailored for emigrants.

ISO Certified Assurance

Benefit from our certified processes ensuring quality in financial planning for emigrants.

Fiduciary Excellence

As a SEBI-registered entity, our commitment is to always prioritise your financial well-being.

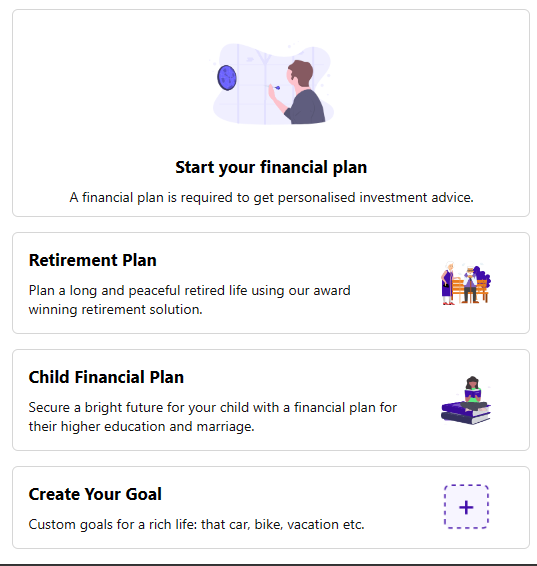

Customized Goal Mapping

Align your investments to personal and family goals across borders.

Data-Driven Insights

With our proprietary analytics, receive unbiased advice tailored for Indian emigrants.

Emigration Financial Planning Benefits

Smooth Financial Transition

Seamless integration of assets and investments across borders ensures stability.

Clear Tax Roadmap

Navigate the complex world of international taxation with clarity and confidence.

Optimal Currency Management

Safeguard your finances against currency fluctuations while emigrating.

Asset Protection

Ensure your assets in India and abroad are protected and thriving.

Frequently Asked Questions

What is emigration financial planning?

How does taxation change when emigrating?

Emigrants may face dual taxation, but with proper planning, you can optimize tax outflows.

How to manage investments in India after emigrating?

With our guidance, manage, and potentially grow your Indian assets from anywhere globally.

What about retirement planning when emigrating?

Plan your retirement considering both Indian and foreign financial products and advantages.

Is insurance transition possible when moving?

While some insurance transitions are possible, we’ll guide on new suitable policies for your destination..

How do currency fluctuations impact emigrants?

Currency values change, but with smart planning, your finances remain protected and optimised.