Financial Planning For Home Loan Repayment

Home Loan Prepayment Mastery. Make Your Home Truly Yours.

Seeking strategies to fast-track your home loan repayment? Harness expert guidance on reducing interest, tax-efficient planning, and smart financial strategies for true homeownership.

Why Prioritize Home Loan Prepayment?

Lowered Interest

Paying off home loans faster means reduced interest, saving lakhs over time.

Debt-free Living

Home ownership feels more rewarding without a lingering debt cloud.

Enhanced Credit Score

Accelerating loan repayment can significantly boost your credit score.

Tax Efficiency

Financial Freedom

Channel money into investments once the home loan is settled, amplifying wealth.

Peace of Mind

A debt-free home offers unparalleled mental peace and stability.

Home Loan Prepayment Planning Services

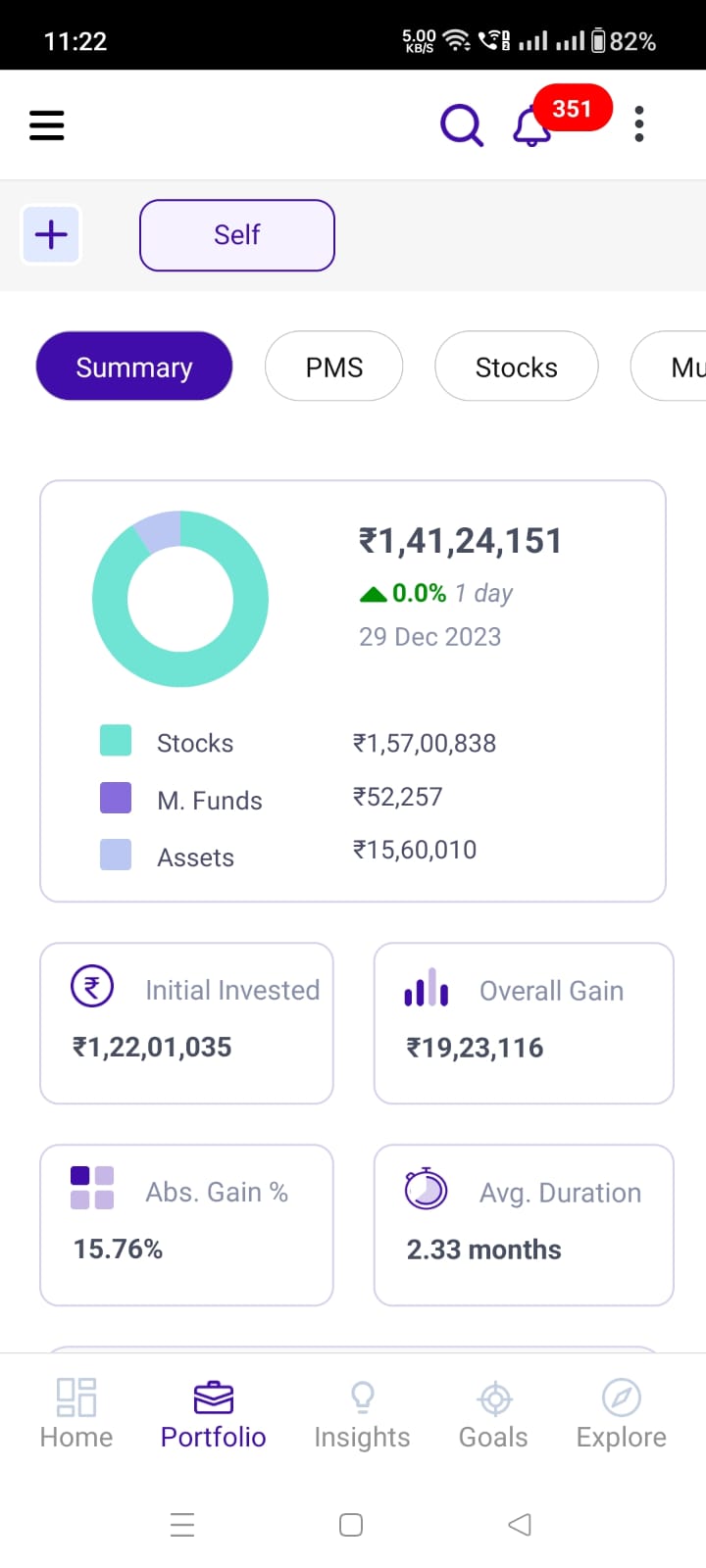

Portfolio Management:

Benefit from a portfolio curated to align with your goals. Experience consistent growth and asset diversification.

Investment Advisory

Seek expert advice tailored for your financial needs. Navigate the complexities of the market with confidence.

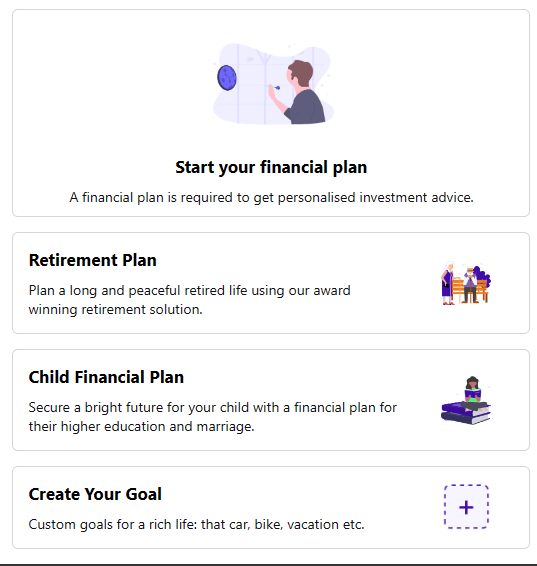

Financial Goal Setting

Establish clear financial objectives for future aspirations. Let us guide your journey towards achieving them.

Insurance Consultation

Safeguard your assets and loved ones effectively. Understand and choose the best insurance plans available.

How Our Unique Approach Benefits You

Deep Expertise

Rely on our proficiency in stocks and mutual funds to redirect savings effectively.

Tech Integration

Use our integrated Mobile and web app for holistic financial tracking.

Certified Excellence

Trust in our ISO 9001 certified processes for meticulous planning.

SEBI Registered

Our fiduciary commitment ensures your interests are always front and center.

Tailored Assurance

Experience financial plans that align assets and goals seamlessly.

End-to-End Service

From advisory to execution, experience unmatched customer service at every step.

Benefits of Home Loan Prepayment Planning

Strategic Expertise

Benefit from tailored strategies that align with your financial aspirations. Navigate the journey of homeownership with seasoned guidance.

Optimized Investments

Ensure every rupee is judiciously allocated for maximum growth. Experience the harmony of a well-balanced investment portfolio.

Holistic Financial Health

Embark on a comprehensive financial journey. From savings to investments, witness your wealth flourish.

Secure Future

With the right insurance and investment advice, ensure a safe future. Rest easy knowing your assets and family are protected.

Frequently Asked Questions

Why consider home loan prepayment?

Accelerated loan repayment reduces interest costs and offers home ownership sooner. Our strategies further enhance these benefits.

Can prepayment affect tax deductions?

While prepayment can impact deductions, our tax-efficient planning ensures you reap maximum benefits and savings.

How to balance prepayment with other financial goals?

Our comprehensive financial planning evaluates all facets, ensuring your goals are met without compromising on important milestones.

Is it always beneficial to prepay?

Mostly, yes. But individual situations vary. Our expert consultation considers all factors to give you tailored advice.

How do I start the prepayment process?

First, evaluate your financial status. Our advisors guide you through a personalized roadmap, considering all nuances.

What about penalties for prepayment?

Some banks might charge a penalty. We help navigate these charges, ensuring your decision remains financially sound.