Corporate Financial Wellness Solutions

Elevating Employee Financial Well-being.

Dive into our Corporate Financial Wellness Solutions tailored for businesses. Our strategies focus on enhancing workforce productivity through financial education, ensuring employee benefit optimization, and improving the overall financial well-being of your employees.

Why Prioritize Financial Wellness Solutions?

Informed Decision-Making

Educated employees make informed financial decisions, promoting stability and confidence in their lives.

Reduced Financial Stress

Employees with financial knowledge experience reduced stress, translating to increased productivity.

Enhanced Productivity

Financially secure employees are more focused, enhancing overall workforce productivity.

Loyal Workforce

Optimized Benefits Utilization

With proper guidance, employees can optimally use the benefits offered, ensuring maximum satisfaction.

Customized Programs

Our solutions are tailored, catering to the unique financial needs and dynamics of your workforce.

Corporate Financial Wellness Solutions Offered

Financial Education Workshops

Equip your workforce with financial knowledge through our interactive workshops. A financially literate employee is a productive asset.

Employee Benefits Advisory

Help your employees maximise the utility of their benefits. Ensure they're leveraging what's available optimally.

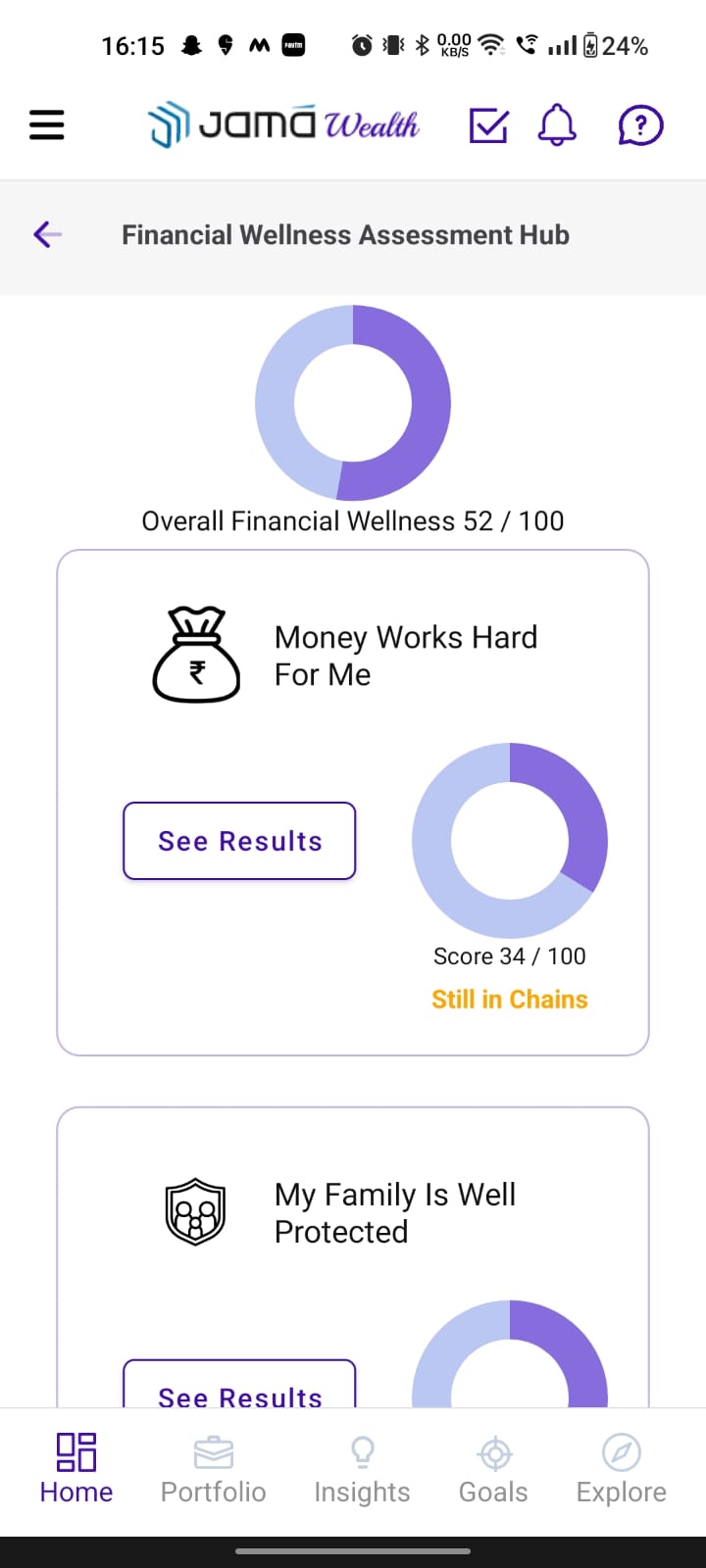

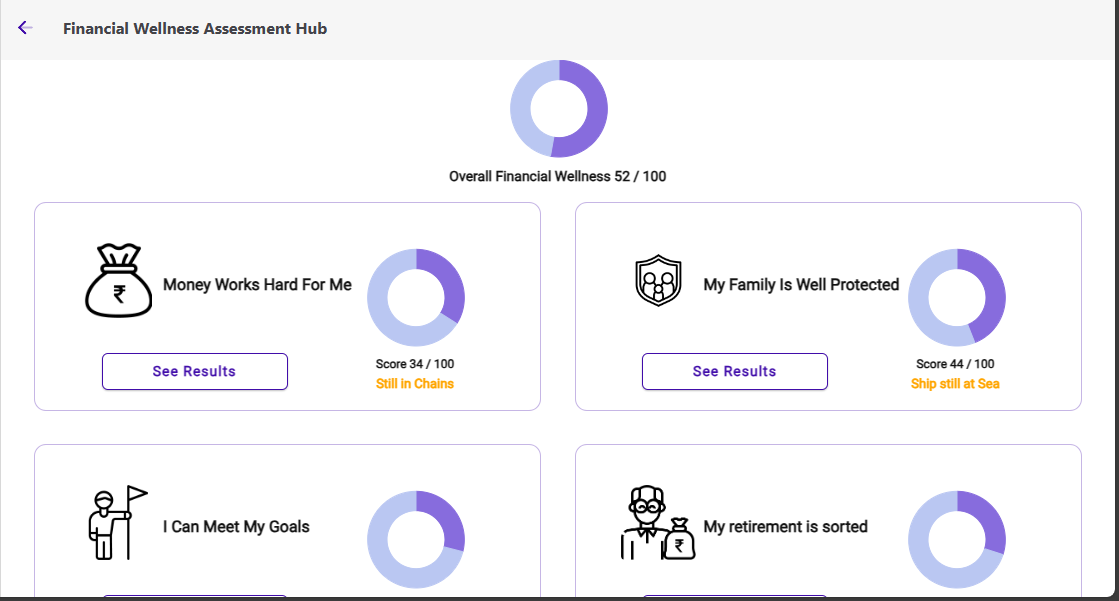

Personal Financial Assessments

Provide individual assessments to understand each employee's financial standing, guiding them towards a secure future.

Retirement Planning Services

Assist employees in planning for their retirement, ensuring they're on the right track for a comfortable future.

How Our Unique Corporate Approach Helps

Expertise-Driven

Deep expertise in stocks and mutual funds ensures accurate advice.

Integrated Technology

Our mobile and web app seamlessly integrate all financial planning steps.

Quality Assured

ISO 9001 certified processes guarantee the best financial planning.

Trusted Fiduciary

Being SEBI registered, we prioritise your business's and employees' interests.

Goal-Centric Planning

Our approach maps all assets and plans to specific financial goals.

Bias-Free Advice

Proprietary data analytics aids in unbiased stocks and mutual funds ratings.

Benefits of Corporate Financial Wellness Solutions

Holistic Employee Growth

Our solutions ensure not just professional, but also personal growth. Financially secure employees exhibit heightened motivation and efficiency.

Company Reputation Boost

Companies prioritising employee well-being are always viewed positively, helping in brand building and trust.

Customized Solutions

Every business is unique, and so are our financial wellness programs, ensuring maximum relevance and impact.

Higher Retention Rates

Employees tend to stay longer with companies that invest in their financial health, reducing recruitment costs.

Frequently Asked Questions

How do financial wellness programs help?

Do you customize the programs?

Absolutely, every business has unique needs. Our solutions are tailored to match your company’s and employees’ specifics.

Is there tech support for your integrated apps?

Yes, our responsive customer service ensures seamless usage of our integrated mobile and web applications.

Are the financial planning processes certified?

Yes, our processes are ISO 9001 certified, ensuring world-class service and advice.

Do you offer individual sessions?

Yes, personal financial assessments are part of our offerings, catering to individual needs.

How does retirement planning fit in?

Retirement planning is essential for long-term financial security. We guide employees to plan and execute it properly.