Financial Planning For Sports Persons

Athlete Financial Planning. Maximizing Potential, Protecting Prosperity.

The athletic arena poses unique financial cycles. From maximising earnings during peak seasons to ensuring security in off-seasons, we tailor plans to the exclusive needs of sports persons, ensuring tax-efficiency and wealth growth.

Why is Athlete Financial Planning Crucial?

Peaking Earnings

Sportspersons often have unpredictable and sometimes short-lived peak earning periods that require smart financial strategies.

Sustaining Wealth

A well-thought-out plan ensures sustained prosperity even after retiring from active sports.

Risk Management

Injuries or sudden breaks can impact earnings, making a stable financial base vital.

Legacy Creation

Tax Optimisation

Unique earnings structures in sports call for tax-efficient financial strategies.

Lifestyle Maintenance

To maintain a comfortable lifestyle post-retirement, forward-thinking planning is essential.

Comprehensive Services for Athlete Financial Planning

Investment Diversification

Broaden your investment horizons ensuring consistent returns regardless of athletic performance.

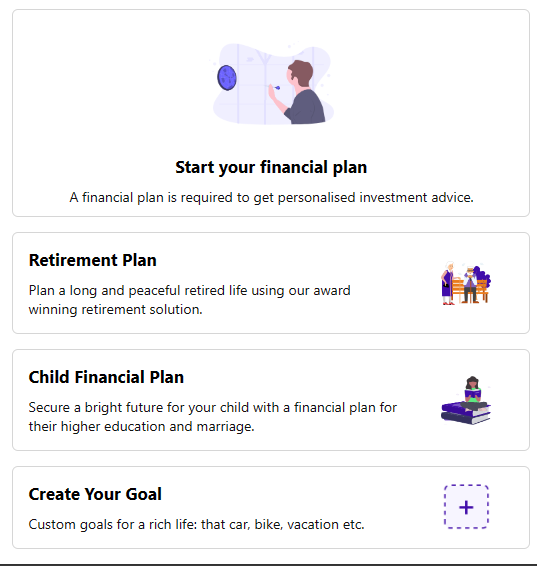

Retirement Planning

Strategies focusing on long-term wealth growth ensuring comfort post-retirement from sports.

Tax Consultation

Leverage our expertise for tax-efficient strategies specially designed for sportspersons' unique income structures.

Insurance Advisory

Protect yourself against unforeseen events, including health issues, with our tailored insurance advice.

How Our Unique Approach Assists Athletes

Sport-Centric Insight

With expertise in stocks and mutual funds, we craft strategies considering sportspersons' unique financial timelines.

Integrated Platform

Our app provides a holistic view from planning to investment, tailored to athletes' schedules.

Certified Excellence

Our ISO 9001 certified planning ensures quality and precision in each financial step.

Fiduciary Commitment

As a SEBI-registered advisor, we prioritise your financial well-being over everything.

Asset-Goal Mapping

Every financial asset you hold will be meticulously aligned to your post-retirement aspirations.

Analytics-Driven Decisions

Our proprietary platform ensures unbiased, data-driven investment advice.

Athlete Financial Planning Benefits

Stable Financial Future

Ensure consistent earnings, mitigating risks associated with a sports career.

Informed Decisions

Benefit from our deep market insight, crafted specifically for sports professionals.

Tax-Optimised Strategies

Smart financial blueprints that maximise post-tax earnings for athletes.

Future-Ready Planning

Be it for a brand or a legacy, ensure your financial strategies are future-centric.

Frequently Asked Questions

How does athlete financial planning differ?

Athletes face unique career trajectories, which need specially tailored financial strategies, ensuring stability and growth.

What investments suit sports professionals?

How can tax be optimised for athletes?

Sportspersons benefit from certain tax structures; we guide on maximising these advantages.

How do you handle sudden income spikes?

Through planned investments, ensuring immediate and future financial stability, maximising the benefits.

Is insurance crucial for sportspersons?

Yes, tailored insurance plans cover potential health risks, ensuring peace of mind.

How do legacy and brand investments fit in?

We guide on smart investments ensuring long-term prosperity and a strong legacy post-retirement.