Financial Planning For Doctors

Navigating Finance, Simplifying Medicine’s Earnings.

Doctors play a crucial role in society, often juggling hectic schedules. Our financial planning solutions, tailored for medical professionals, help physicians maximize their earnings, ensuring a tax-efficient and stable financial future.

Why Doctors' Financial Planning Matters?

Intrinsic Challenges

Medicine presents unique financial hurdles. Tailored financial strategies help doctors navigate these challenges, ensuring long-term financial health.

High Earnings Management

With potential high earnings, doctors need strategies to manage, grow, and protect their wealth optimally.

Changing Regulations

The healthcare sector often sees regulatory shifts. Stay ahead with our proactive financial planning.

Investment Diversification

Retirement Assurance

While doctors serve long hours, a well-planned retirement is essential. Our strategies guarantee peaceful retirements.

Liability Protection

Malpractice suits, though rare, can be hefty. Financial planning can shield doctors from unforeseen liabilities.

Premier Doctors' Financial Planning Services

Portfolio Diagnostics

Dive into the health of your investments. Get a clear picture of your current portfolio's strengths and weaknesses, aiding in future investment decisions.

Strategic Wealth Management

Optimise your hard-earned money. Receive tailor-made strategies to help your wealth grow consistently, adapting to the market's rhythms.

Comprehensive Tax Planning

Navigate the tax maze with ease. Benefit from specialized strategies to minimise tax liabilities and maximise savings, particularly designed for doctors.

Risk Cover Consultation

Protect what you've built. Expert advice on insurance solutions, ensuring your assets and practice are secure against unforeseen challenges.

How Our Unique Approach Benefits Doctors

Deep Expertise

Our deep knowledge in stocks and mutual funds ensures optimal investments. We understand the nuances of the medical profession.

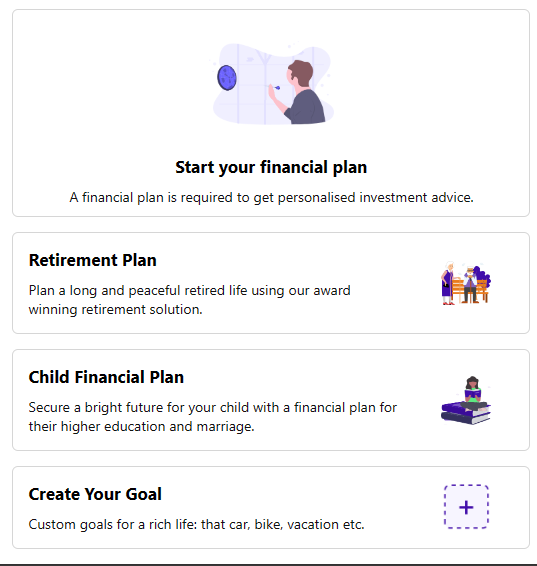

Integrated Platform

Our mobile and webapp seamlessly integrates financial planning with investment strategies. Effortlessly move from planning to execution.

Certified Excellence

ISO 9001 processes ensuring top-notch services, from financial planning to investment strategies. Consistent and quality advice.

Trusted Fiduciary

SEBI-registered advisor and portfolio manager; trust is at our core. Your interests always come first.

Goal Mapping

Our unique financial plan assurance aligns assets and investments with your goals. Every rupee is accounted for.

One-stop Solution

From advisory to execution, experience stellar customer service. Leave the complexities to us.

Key Benefits of Doctors' Financial Planning

In-depth Industry Insight

We understand the unique financial challenges faced by doctors. Our specialized advice ensures a secure, prosperous future.

Streamlined Wealth Growth

Capitalise on your earnings. Experience consistent growth with strategies tailored for medical professionals.

Holistic Financial Health

From tax planning to insurance, get a 360-degree view of your financial landscape, ensuring no aspect is overlooked.

Absolute Peace of Mind

With our expertise, doctors can focus on their profession, knowing their financial future is in good hands.

Frequently Asked Questions

How is financial planning for doctors unique?

Medical professionals often have varied income streams and longer educational paths. Tailored financial planning understands these nuances, ensuring optimal financial health.

Can I protect against malpractice suits?

How do regulatory changes impact me?

The healthcare sector has its regulations. We stay updated, ensuring your financial plans remain compliant and advantageous.

Is retirement planning necessary?

Absolutely. Ensuring a comfortable retirement after years of service is crucial. Our strategies make this a reality.

Do you offer digital solutions?

Yes. Our integrated mobile and webapp offers a seamless experience from planning to execution and tracking.

How are investment decisions made?

Without third-party bias, our proprietary data analytics platform rates stocks and mutual funds, ensuring your interests are paramount.