Investment Advisory For Large Cap Stocks - Jewel Top 350

Build wealth steadily through a judicious mix of high quality Large and Midcap Stocks

Achieve capital appreciation by investing in a mix of large and mid-cap companies that have strong balance sheets and growing earnings. These companies typically have ₹10,000 crore market cap (roughly $1.5B+) and offer steady growth over the long term.

Why Trust Maxiom Wealth's JEWEL Large & Midcap Investment Advisory

STABILITY

Large cap companies grow well with the economy and can anchor the portfolio in turbulent times.

GROWTH

Midcap stocks often present robust growth prospects, being at an inflection point in their evolution.

DIVERSIFICATION

A varied equity portfolio across various sectors can provide better risk distribution.

Balanced Approach

INDUSTRY LEADERS

The best large cap companies are leaders in their respective industries which augurs well for a long term portfolio.

EMERGING TRENDS

Midcap companies have potential to become tomorrow’s market leaders. JEWEL taps into these trends.

Services Offered

Strategic Allocation

Our experts manage your investments in high quality stocks allocated across large and mid caps across various sectors.

Portfolio Customisation

Every investor is unique. We are able to tailor portfolios that reflect investor constraints, risk appetite and financial aspirations. This is helpful for CEOs, CXOs or industry leaders with existing large sectoral exposures

'Full Service' With Rebalancing

The dynamic nature of the stock market necessitates regular portfolio adjustments. We keep portfolios aligned (including transaction management) with the market developments and company performances as reflected in their quarterly results.

Risk Mitigation

With proactive strategies, we ensure client investments are resilient against market uncertainties. Stocks that do not meet the stringent quality criteria are placed on 'watch' or are exited. Our Fund Manager is available for allaying any concerns.

How Maxiom Wealth JEWEL Investment Advisory Amplifies Your Wealth Creation Journey

Long Term Focus

Focus on long-term capital appreciation through investments in small-cap companies with strong fundamentals and high growth potential.

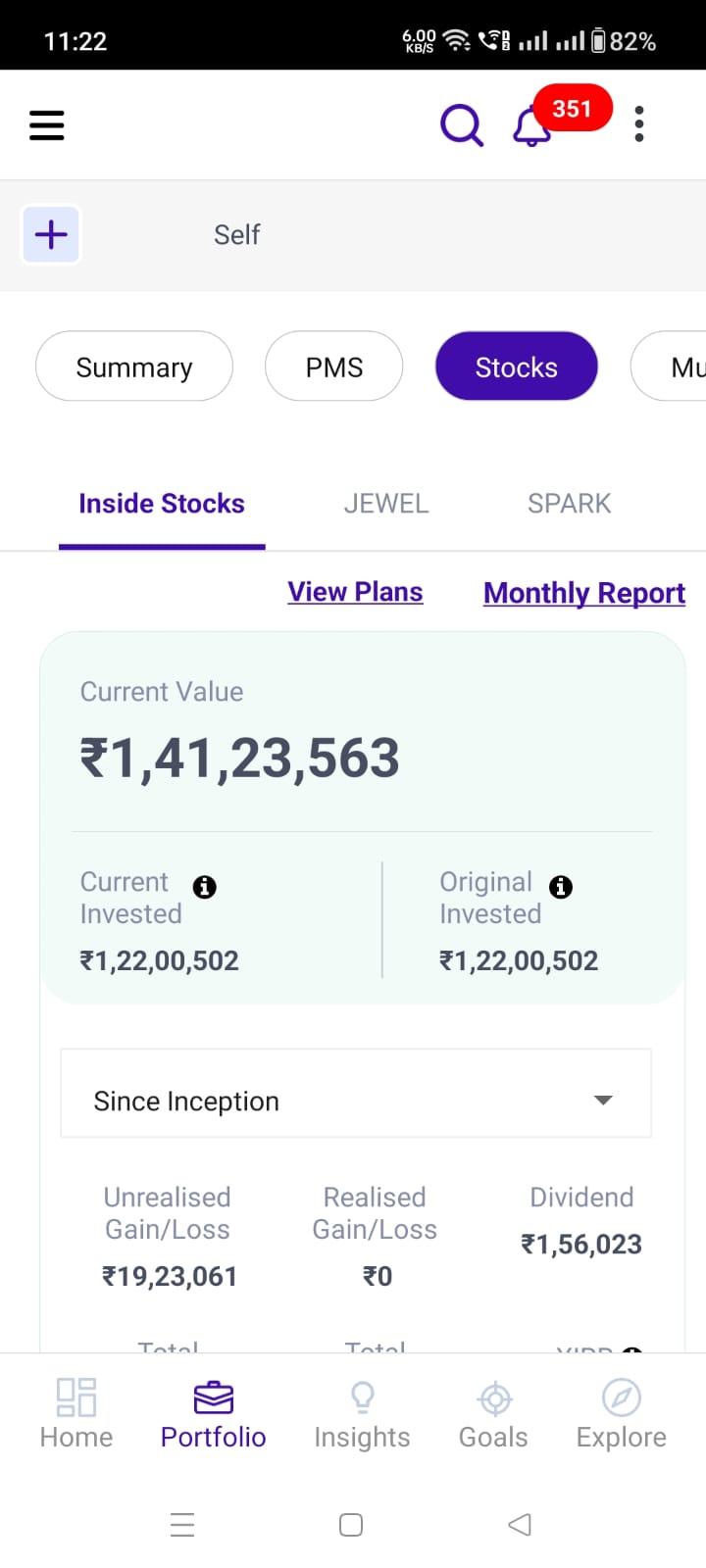

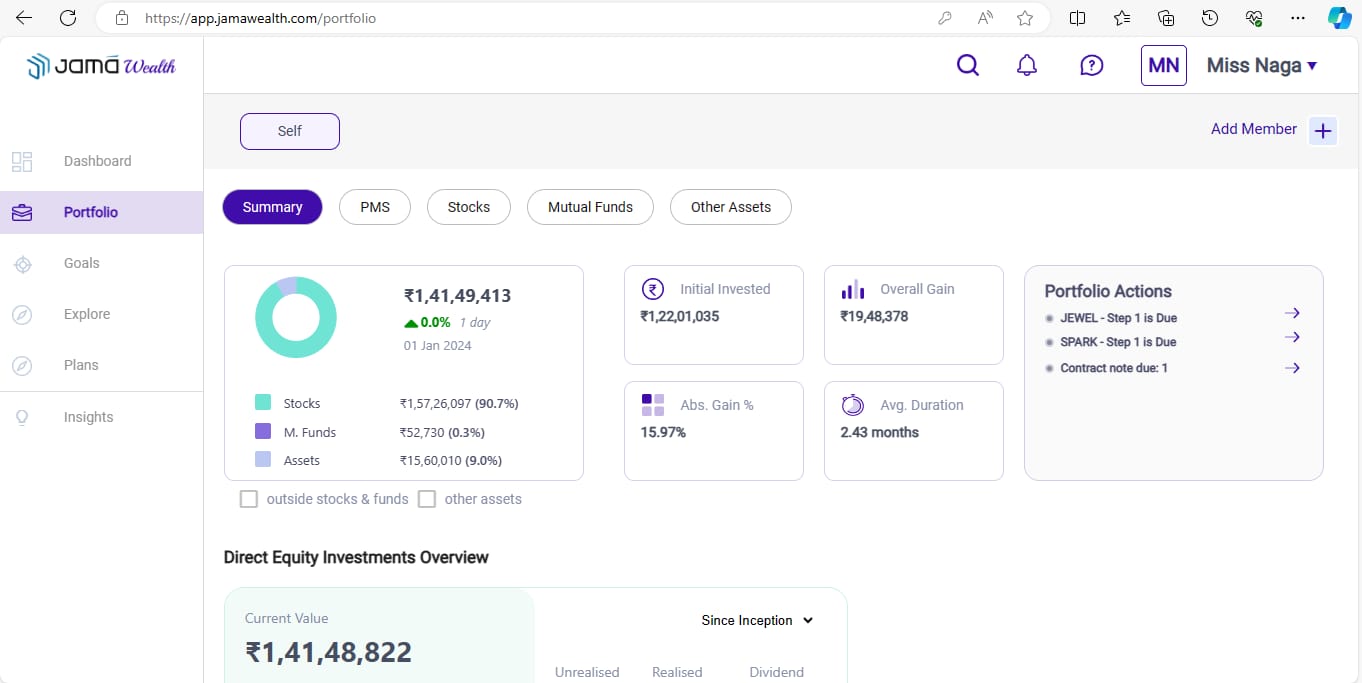

Tech-Savvy

Our integrated app offers an end-to-end seamless investment experience.

Process Adherence

We stick to a proven investment philosophy and processes that ensure decisions are consistent and free of emotional bias.

Trustworthy Guidance

Attention to early risk indicators and periodic review for portfolio churn decisions.

Data-Backed Decisions

Our analytics platform offers objective stock evaluations.

All-Round Service

From advisory to execution, we’re your dedicated investment partner.

Bottomline: Benefits of Investing In Large & Midcap Stocks

Promising Returns

Large & Midcap equities offer a blend of stability and growth potential.

Strategic Diversification

A balanced portfolio can weather market volatilities better.

Adaptive Nature

Midcap firms often adapt quicker to market changes whereas Largecap firms tend to be resilient.

Growth Prospects

Investing in market leaders of today and tomorrow.

Frequently Asked Questions

Why invest in both large and midcap equities?

This gives a good balance of risk and return for most investors. Large caps give steady returns whereas midcaps offer a blend of growth and resilience, potentially becoming market leaders.

How do you select stocks?

Through in-depth research, data analytics, and understanding market dynamics.

How often do you review my portfolio?

Regular reviews, especially post quarterly results and significant market events, ensure optimal growth.

Is midcap investing risky?

While there’s inherent market risk, our strategies are designed to mitigate them effectively.

Do you use any technology for analysis?

Yes, our proprietary data analytics platform aids in objective stock evaluations.

How can Maxiom Wealth add value?

With our deep expertise and client-first approach, we aim to maximise your returns.